Exactly How Livestock Danger Defense (LRP) Insurance Coverage Can Safeguard Your Livestock Investment

In the world of livestock financial investments, mitigating risks is vital to ensuring financial security and development. Livestock Danger Defense (LRP) insurance coverage stands as a reputable shield against the uncertain nature of the marketplace, providing a tactical approach to securing your properties. By delving into the ins and outs of LRP insurance coverage and its multifaceted benefits, animals manufacturers can strengthen their investments with a layer of protection that transcends market variations. As we explore the realm of LRP insurance policy, its duty in protecting animals financial investments comes to be increasingly obvious, promising a path in the direction of lasting economic strength in an unpredictable sector.

Comprehending Animals Danger Defense (LRP) Insurance

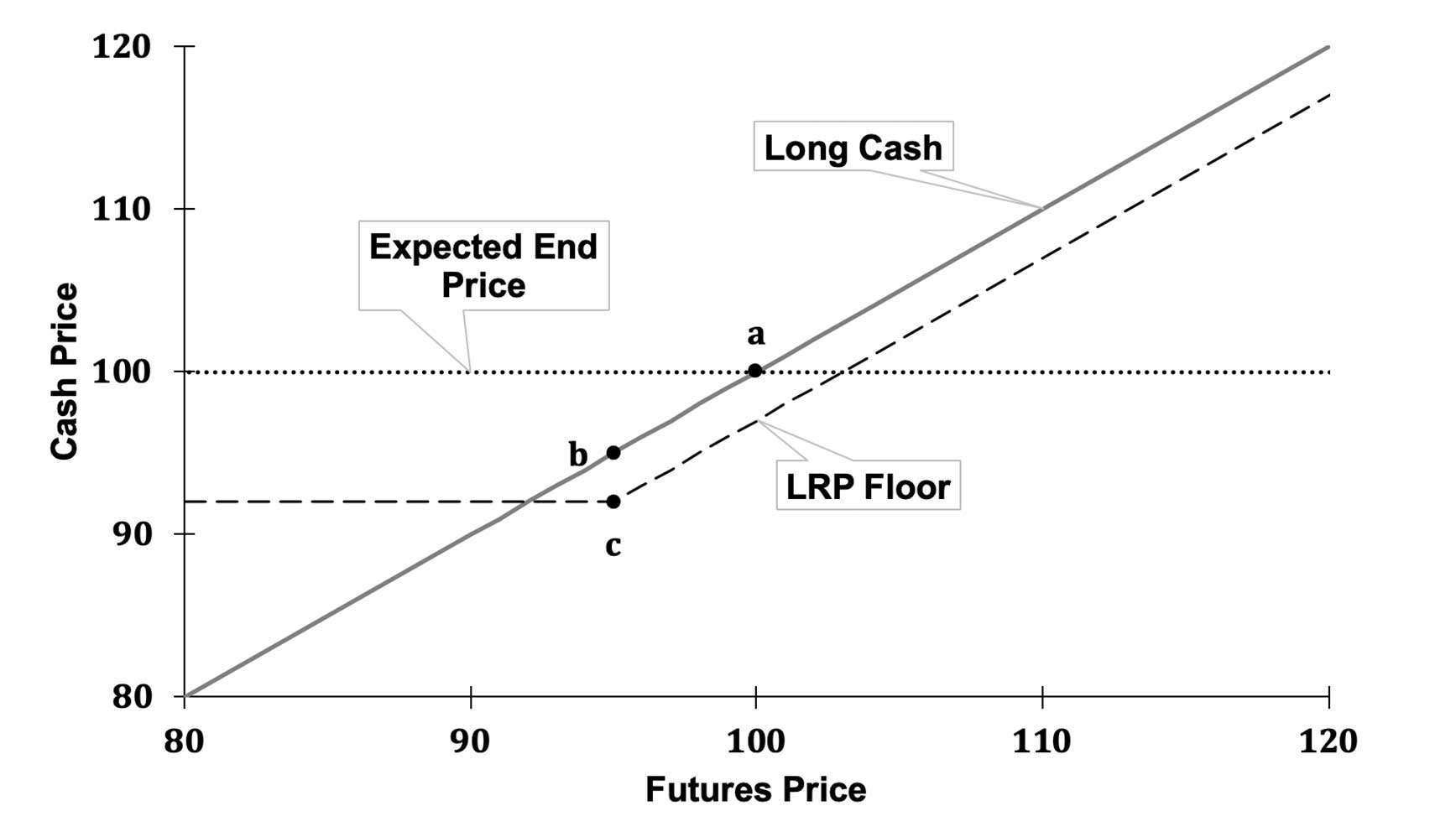

Understanding Livestock Threat Security (LRP) Insurance coverage is necessary for livestock manufacturers wanting to mitigate economic threats linked with cost variations. LRP is a government subsidized insurance item designed to shield producers against a decline in market costs. By providing coverage for market price decreases, LRP aids producers secure in a floor cost for their animals, guaranteeing a minimal level of profits no matter market changes.

One secret facet of LRP is its flexibility, permitting producers to personalize insurance coverage degrees and plan lengths to fit their details needs. Producers can pick the variety of head, weight variety, insurance coverage rate, and coverage period that straighten with their manufacturing goals and run the risk of resistance. Recognizing these customizable choices is crucial for manufacturers to properly manage their price danger direct exposure.

In Addition, LRP is offered for numerous livestock types, including cattle, swine, and lamb, making it a flexible danger management device for animals producers throughout different sectors. Bagley Risk Management. By acquainting themselves with the complexities of LRP, manufacturers can make enlightened decisions to secure their financial investments and ensure financial stability despite market unpredictabilities

Advantages of LRP Insurance for Livestock Producers

Animals manufacturers leveraging Animals Danger Protection (LRP) Insurance policy get a calculated benefit in protecting their investments from rate volatility and protecting a stable economic footing in the middle of market uncertainties. By establishing a floor on the rate of their animals, producers can reduce the risk of considerable financial losses in the occasion of market recessions.

In Addition, LRP Insurance policy gives manufacturers with tranquility of mind. On the whole, the advantages of LRP Insurance coverage for livestock producers are substantial, providing an important tool for managing threat and making certain economic protection in an uncertain market setting.

Exactly How LRP Insurance Coverage Mitigates Market Risks

Alleviating market risks, Animals Danger Protection (LRP) Insurance policy supplies livestock producers with a reputable shield versus price volatility Web Site and monetary uncertainties. By supplying security against unforeseen price decreases, LRP Insurance aids producers secure their financial investments and maintain economic stability despite market fluctuations. This sort of insurance coverage permits livestock manufacturers to lock in a rate for their animals at the start of the policy duration, ensuring a minimum rate degree no matter market modifications.

Actions to Secure Your Livestock Financial Investment With LRP

In the realm of agricultural danger monitoring, implementing Livestock Danger Defense (LRP) Insurance includes a calculated procedure to guard investments against market fluctuations and uncertainties. To protect your animals financial investment properly with LRP, the first step is to examine the specific risks your procedure deals with, such as cost volatility or unanticipated climate events. Next, it is vital to study and pick a respectable insurance coverage copyright that provides LRP policies tailored to your livestock and company requirements.

Long-Term Financial Safety With LRP Insurance Coverage

Guaranteeing withstanding monetary stability through the utilization of Animals Threat Defense (LRP) Insurance is a sensible lasting method for agricultural producers. By including LRP Insurance policy into their risk administration plans, farmers can safeguard their animals financial investments against unexpected market changes and negative events that could threaten their monetary well-being with time.

One trick advantage of LRP Insurance coverage for long-term economic safety is the comfort it supplies. With a dependable insurance plan in place, farmers can mitigate the monetary risks connected with unstable market problems and unexpected losses due to factors such as condition episodes or natural disasters - Bagley Risk Management. This stability allows manufacturers to concentrate on the everyday operations of their animals company without consistent bother with prospective economic obstacles

Moreover, LRP Insurance coverage provides a structured strategy to handling this post threat over the lengthy term. By establishing certain coverage levels and picking suitable endorsement durations, farmers can customize their insurance coverage intends to straighten with their economic goals and run the risk of resistance, guaranteeing a lasting and secure future for their livestock procedures. To conclude, buying LRP Insurance coverage is an aggressive approach for agricultural producers to accomplish long-term financial safety and security and secure their resources.

Conclusion

In final thought, Livestock Threat Defense (LRP) Insurance coverage is a useful go to this site device for animals producers to mitigate market dangers and secure their investments. By recognizing the benefits of LRP insurance and taking steps to apply it, producers can achieve long-lasting monetary safety for their procedures. LRP insurance policy offers a security net against price changes and makes sure a degree of stability in an uncertain market environment. It is a sensible selection for securing animals investments.